nd sales tax rate 2021

Pursuant to Document 144641 as adopted May 5 2021 the boundaries of the City of Elgin will change for sales and use tax purposes effective April 1 2022. This rate includes any state county city and local sales taxes.

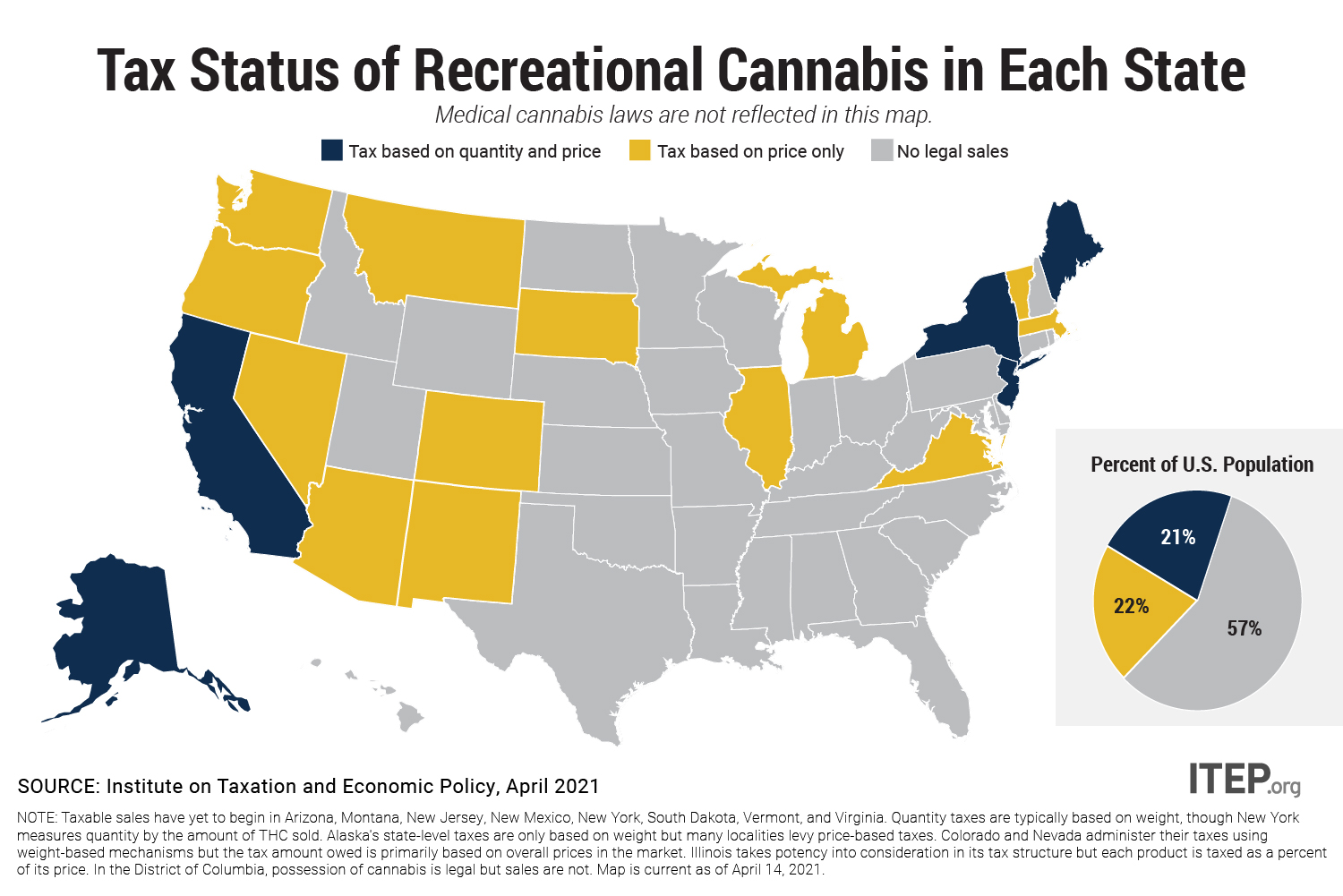

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

Groceries are exempt from the North.

. Taxes in North Dakota North Dakota Tax Rates Collections and Burdens. Lowest Sales Tax 45 Highest Sales Tax 85 North Dakota Sales Tax. The Williston sales tax rate is.

Did South Dakota v. The North Dakota sales tax rate is currently. Please refer to the following links if you.

Wayfair Inc affect North Dakota. Find 49900 - 49950 in the. Gross receipts tax is applied to sales of.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. The Minot sales tax rate is. 30 rows The state sales tax rate in North Dakota is 5000.

Alcohol at 7 New farm machinery used exclusively for agriculture. This is the total of state county and city sales tax rates. The Fargo sales tax rate is.

Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. Groceries are exempt from the North. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

The County sales tax rate is. 2020 rates included for use while preparing your income tax deduction. This is the total of state county and city sales tax rates.

Schedule ND-1NR line 22 to calculate. The County sales tax rate is. The 2018 United States.

How does North Dakotas tax code compare. The County sales tax rate is. 5 Average Sales Tax With Local.

With local taxes the total sales tax rate is between 5000 and 8500. North Dakota has a graduated individual income tax with rates. Arkansas went from 2 nd to 3 rd.

NORTH DAKOTA STATE COUNTY CITY SALES TAX RATES 2021 Register Online This page lists an outline of the sales tax rates in North Dakota. Did South Dakota v. Effective January 1 2021 the City of Wyndmere has adopted an ordinance to increase its city sales use and gross receipts tax by 1.

Exact tax amount may vary for different items The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. There are a total of 214 local. Did South Dakota v.

Taxpayers are residents of North Dakota and are married filing jointly. The tax rate for northwood starting january 1 2021 will be 25. This is the total of state county and city sales tax rates.

Exact tax amount may vary for different items The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. City of Fargo North. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

In North Dakota theres a tax rate of 11 on the first 0 to 40125 of income for single or married filing taxes separately. The latest sales tax rate for Fairdale ND. The North Dakota sales tax rate is currently.

The North Dakota sales tax rate is currently. Find your North Dakota combined state and local tax rate. The current total local sales tax rate in Williston ND is 8000.

The December 2020 total local sales tax rate was also 8000. Updates are posted 60 days prior to the changes becoming effective. If youre married filing taxes jointly theres a tax rate of 11.

North Dakota has recent rate changes Thu. The Bismarck sales tax rate is. The North Dakota sales tax rate is currently.

Easily manage tax compliance for the most complex states product types and scenarios. Their North Dakota taxable income is 49935. Local Sales Tax Rate Lookup The Sales and Use Tax Rate Locator only includes state and local sales and use tax.

596 North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 3. The County sales tax rate is. Easily manage tax compliance for the most complex states product types and scenarios.

The tax rate for Wyndmere starting.

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

North Dakota Sales Tax Rates By City County 2022

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

How Do State And Local Individual Income Taxes Work Tax Policy Center

Georgia Sales Tax Rates By County

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

North Dakota Estate Tax Everything You Need To Know Smartasset

Florida Sales Tax Small Business Guide Truic

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation