tesla model y tax credit irs

Are Any Other Manufacturers Close to. This question regards submission of my request for 7500 tax credit for 2018.

![]()

Mx Now 100 Tax Deductible For A Business Tesla Motors Club

Senate through a non-binding solution has approved a 40000 price threshold on qualifying electric cars that would be eligible for a 7500 federal tax credit.

. Current EV tax credits top out at 7500. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. It no longer applies to Tesla because the company passed the threshold of selling 200000 electric vehicles in the US.

Initially the tax credit was cut in half from 7500 down to 3750. Tesla was too popular. Apparently you can deduct up to 18100 the first year.

The credit may also be increased to a maximum of 12500. This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery. E-tron SUV 2019 2021-2022 7500.

First here are some Tesla vehicles that will qualify for the Tax Credit. Both are work-arounds unless the IRS letter that HR Block thinks Tesla is supposed to produce says the tentative credit amount for a June 2019 delivery is 7500 - which also makes no sense. E-tron GT RS e-tron GT 2022 7500.

Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. Select utilities may offer a solar incentive filed on behalf of the customer. Aspiring Tesla owners should pay close attention.

I did a little more digging on certain tax forms about bonus depreciation under 179 if the vehicle weighs less then 6000 lbs. The price cuts come as the recently proposed law to renstate the 7000 EV tax incentive makes EV buyers. Federal tax credit form 8936 of up to 7500 for the purchase of some new electric vehicles.

Continouing with its price cuts Tesla has once again lowered the price of the Model 3 Y. In anticipation of the upcoming EV tax credits Tesla is adjusting its pricing accordingly. Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal tax credit.

Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the. Tesla has been selling the Model S Model X and Model 3 for years already and GMs eligibility for any portion of the tax credit ended March 31 2020. Manchin a no on Build Back Better bill putting 12500 incentive in doubt.

Has sold more than 200000 vehicles eligible for the plug-in electric drive motor vehicle credit during the third quarter of 2018This triggers a phase out of the tax credit available for purchasers of new Tesla plug-in electric vehicles beginning Jan. For instance once Tesla sold 200000 vehicles no matter which model it was the credit was phased out. IRS or Federal Tax Credits by manufacturer for New All-Electric EV andor Plug-in Hybrid Vehicles.

Entry level model S starts at 79690 Model 3 starts at 39690 Model Y starts at 51990. During 2021 the US. Q4 50 e-tron Quattro.

Make and Model. My accountant seems fairly blase regarding submission of forms while someone on this forum referenced a form 8936 obtained from the IRS that has a maximum credit in box 10 of 2500 per vehicle. 1500 tax credit for lease of a new vehicle.

However if you are in the market for a Tesla Model Y then you might not get as sweet of a deal. Tesla Model Y price increased for the eighth time in 2021 ahead of EV tax. Senator Joe Manchin said on Sunday hes a no on the sweeping spending plan which includes up to.

For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an additional 417 for each kilowatt hour of. The Tesla Team August 10 2018. By 2020 the subsidy will be zero dollars for Tesla.

All of the Tesla lineup models including the Model S Model X Model 3 and Roadster have exceeded the limit. EV tax credits. But if you use the vehicle for business you can still depreciate it and write of up to 100 of the cost depending on the type of depreciation you choose.

The new EV tax credits proposed by the Biden administration are bound to encourage more EV sales. WASHINGTON The IRS announced today that Tesla Inc. Last month Tesla sold its 200000th such vehicle and since then weve.

The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. The Plug-in Electric Drive Motor Vehicle Credit electric car tax credit is a short-term incentive to offset the initial higher purchase price of qualified vehicles. This tax credit begins to phase out once a manufacturer has sold 200000 qualifying vehicles in the US.

The federal EV tax credit is the first to run out for electric carmaker Tesla on Dec. To put it simply. As most people know there is currently a US.

IR-2018-252 December 14 2018. So there is some confusion in this matter. E-tron Sportback 2020-2022 7500.

I believe Anyway the new Tesla Model Y came out for the consumer and it is below 6000lbs which is the threshold for qualifying. Tesla cars are no longer eligible for the electric vehicle tax credit. 2500 tax credit for purchase of a new vehicle.

Tesla Ev Tax Credits Coming Back Page 92 Tesla Motors Club

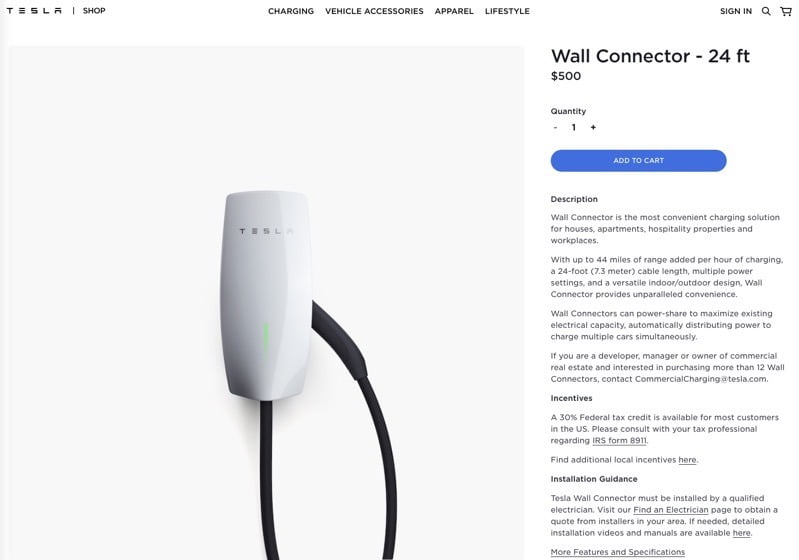

Tesla Brings Back Wall Connector With 24 Foot Cable Option Update Teslanorth Com

How The Irs Taxes Cryptocurrency And The Loophole That Can Lower Your Tax Bill Gobankingrates

Time To Plug In Long Island Weekly

Tesla Ev Tax Credits Coming Back Page 80 Tesla Motors Club

Tesla Model 3 Can Now Officially Cost Only 25 000 In California After Incentives R Teslamotors

Turbo Tax Rebate Info Questions Tesla Motors Club

Taxes 2022 The Neediest Americans Must Wait Longer For Tax Refunds